Business credit evaluation protects companies from vendor defaults, supply chain disruptions, and financial loss. Proper credit assessment ensures reliable partnerships, reduces operational risks, and maintains steady business operations through careful partner selection.

Supply chain vulnerabilities can devastate business operations. Vendor failures can create costly disruptions that ripple through entire organizations, affecting delivery schedules and customer satisfaction. Smart companies recognize that thorough financial vetting can prevent these expensive setbacks.

When organizations check business credit for potential partners, they gain crucial insights into vendor stability and reliability. This financial assessment reveals payment patterns, outstanding debts, and overall fiscal health that directly impact partnership success. Credit evaluations expose red flags before contracts are signed and commitments are made.

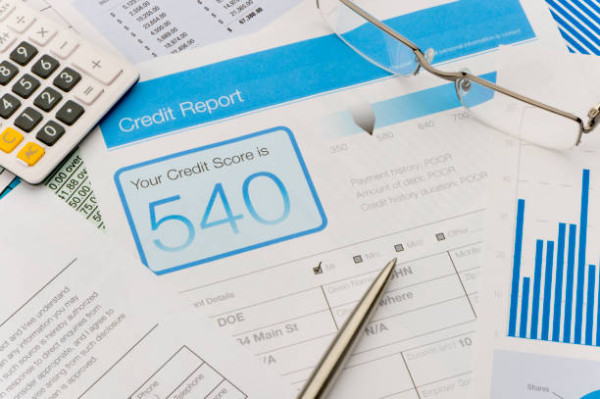

Business credit reports provide comprehensive data about vendor financial performance, including payment history, credit utilization, and bankruptcy records. These detailed assessments help businesses make informed decisions about which suppliers can deliver consistent service. The reports also reveal trends that indicate whether vendors are growing stronger or facing potential difficulties.

Key Components of Vendor Credit Analysis

- Financial Stability Indicators: Credit reports contain multiple data points that signal vendor reliability and long-term viability. Payment history shows how consistently vendors meet their obligations, while credit scores provide standardized risk assessments. Outstanding liens, judgments, and bankruptcies reveal potential instability that could affect service delivery and contract fulfillment.

- Industry-Specific Risk Factors: Different sectors present unique challenges that require specialized evaluation approaches. Manufacturing vendors face inventory and equipment financing pressures, while service providers depend heavily on cash flow management. Understanding these sector-specific risks can help a business interpret credit data more accurately and make better partnership decisions.

Essential Steps for Vendor Credit Verification

- Credit Report Acquisition: Obtaining vendor credit information requires proper authorization and follows specific legal procedures. Businesses must secure written consent before accessing detailed financial records, ensuring compliance with privacy regulations. The process involves contacting credit reporting agencies that specialize in commercial credit data and maintaining accurate vendor identification information.

- Data Analysis and Interpretation: Raw credit data requires careful analysis to extract meaningful insights about vendor reliability. Key metrics include:

- Payment timeliness across multiple creditors and time periods.

- Credit utilization ratios that indicate financial management effectiveness.

- Outstanding legal actions or judgments that could affect business operations.

- Industry comparison data that contextualizes individual vendor performance metrics.

- Risk Assessment Framework: Effective vendor evaluation uses structured approaches that weigh multiple risk factors simultaneously. High-risk indicators include recent bankruptcies, declining payment performance, and excessive debt loads relative to business size. Low-risk vendors demonstrate consistent payment patterns, manageable debt levels, and positive industry standing over extended periods.

Implementation Strategies for Supply Chain Protection

- Ongoing Monitoring Systems: Credit assessment shouldn’t end after initial vendor selection but continue throughout the business relationship. Regular monitoring detects changes in vendor financial health that could affect service delivery or contract performance. Automated alert systems notify businesses when vendor credit ratings decline or negative events occur.

- Alternative Verification Methods: Credit reports work best when combined with other verification approaches that provide comprehensive vendor assessments. References from other customers reveal service quality and reliability patterns not captured in financial data. Site visits and operational assessments confirm that vendors have the capabilities and resources necessary for a successful partnership.

Effective vendor credit evaluation protects businesses from supply chain disruptions while enabling confident partnership decisions. The investment in proper due diligence pays dividends through reduced operational risks and stronger vendor relationships.

Start implementing comprehensive credit assessment processes today to safeguard your business operations and maintain a competitive advantage in your marketplace.

Featured Image Source: https://media.gettyimages.com/id/643153492/photo/credit-report-form-on-a-desk.jpg?s=612×612&w=0&k=20&c=1GJwFq89A1jTsnRmyXrPYWrRopZOXL6m4F_Nv4XwuAA=